NFT Floor Manipulation

Deep Dive of how NFT projects get manipulated by bad actors

NFTs are a powerful tool for onboarding new users to the Solana ecosystem. This applies to other chains as well which have NFTs. NFTs have exploded into the mainstream in recent years among buyers. With many celebrities buying the famous NFT collections and many brands launching their own NFTs, the space is set to grow further. While the current market scenario for NFTs is not good, there is no harm in knowing about a common challenge the space faces - Floor price manipulation. The challenge is so big that people who want to explore NFTs think the entire space is manipulated and do not want to get into it.

With this piece let us understand

What is an NFT floor price?

How easily NFT floor prices can be manipulated?

The ramifications of floor manipulation

How to avoid getting scammed?

What is the Floor price?

The floor price is the lowest price of an NFT in a collection that is available for purchase. It is a widely used metric by both collectors and traders.

Floor price is an easy metric to begin the analysis of the NFT projects as it tells one about the popularity of the project. A common assumption among the new NFT buyers is that a high floor price usually means the project is popular. And a low price means that no one is interested in the project.

An example to understand floor price

Please note: This is an example to understand what is floor price and not about the manipulation. We will understand the manipulation part after this section.

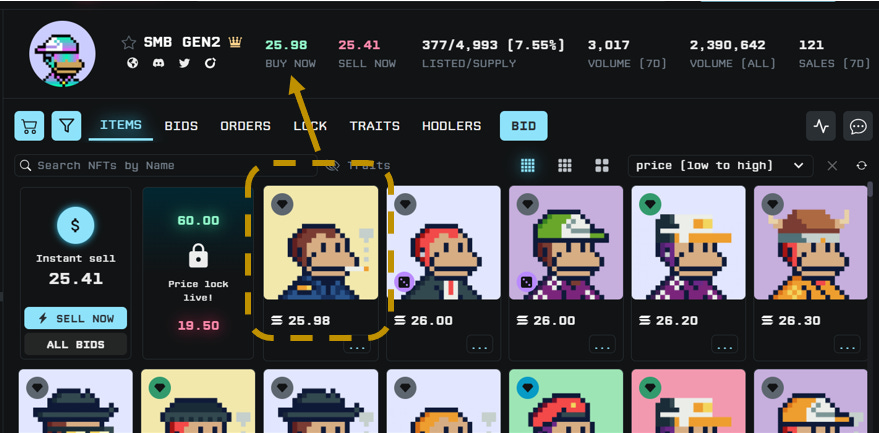

Example: On the NFT marketplace Tensor, there are 377 NFTs of the OG & Popular NFT collection Solana Monkey Business listed for sale.

The lowest priced NFT for sale is 25.98 SOL. And this price is the floor price of the collection.

If someone buys this Floor priced NFT

then the floor price increases to the next lowest priced NFT available. Now the new floor will become 26 SOL

But if someone wants to sell a different SMB NFT at 25 SOL

then the floor will decrease to 25 SOL

Floor price is a good entry point for beginners because of its simplicity to understand. However, it is easily manipulated as well. Now, Solana Monkey Business is a popular and respected NFT on Solana which may make it less prone to floor price manipulation. But the same can’t be said for every other project.

The floor price is just the lowest priced NFTs of that collection. There would be many other NFTs in the collection with a significantly higher price as per their traits.

In a collection of 100 NFTs, even if 95 of the NFTs are trading at 100 SOL, if just 1 NFT is trading at 70 SOL, then the floor price of that collection is 70 SOL

So floor price is not the best indicator of the NFT collection values and can be manipulated easily. As it shows the lowest price of the collection but does not indicate if the value of the NFT is that much.

Sweeping the Floor - How does the manipulation happen?

A way of manipulating the floor prices is a scenario where a buyer purchases all the NFTs available that are at the lowest price is commonly known as “sweeping the floor”. This may be a malicious attempt to create an illusion that the project is growing.

Both new and established projects are prone to manipulation. But it usually happens with newer projects because they are traded and bought frequently. The bad actors try to create an artificial demand for the project so that they can earn profits later.

There are NFT Scalping bots as well which sweep the floors and raise the floor of the NFT collection. As the lowest priced NFTs on sale are bought by these bots, a normal buyer doesn't get to buy the lower price NFT. Now they have to buy any of the remaining NFT at a higher price than they would have earlier.

Using this artificially inflated floor price of the collection, they can list their swept NFTs at a higher price, even though the collection may not actually be valued at that higher price if not for the floor manipulation.

The price no longer reflects the value of the collection as the manipulators do not have the intention of holding the NFTs for a longer duration. They are not in it for the value but just to deceive other buyers.

Projects themselves may also arrange sweeping to raise the floor and the overall price of the collection so that the project appears valuable.

Another way of manipulation - Undercutting the floor

Manipulators can also dump a few of their collections to decrease the floor price.

Undercutting means they list their NFTs below the floor price trying to sell the NFT fast. The decrease in floor price may imply that the project is losing its steam and there is a panic among retail users and they also start selling their NFTs off.

Source: https://twitter.com/feyi_x/status/1487882318463254528?s=20

In the example below, the user has been dumping the NFT in their own or colluded account. From 0.11 it dropped to 0.0988.

Source: https://twitter.com/YoshiJoshi_/status/1571955251657478144?s=20

Once there is a panic sell-off among the holders, these manipulators get to buy the NFTs of other sellers at a price way below the floor. Then they delist the newly bought NFTs so the floor price increases again.

Challenges with varied liquidity across Marketplaces

With the increase in the NFT marketplaces the liquidity gets scattered. There is also an increase in the niche marketplaces which cater to a specific user segment such as games, music, and art.

The volume difference makes it easy to manipulate the floor price.

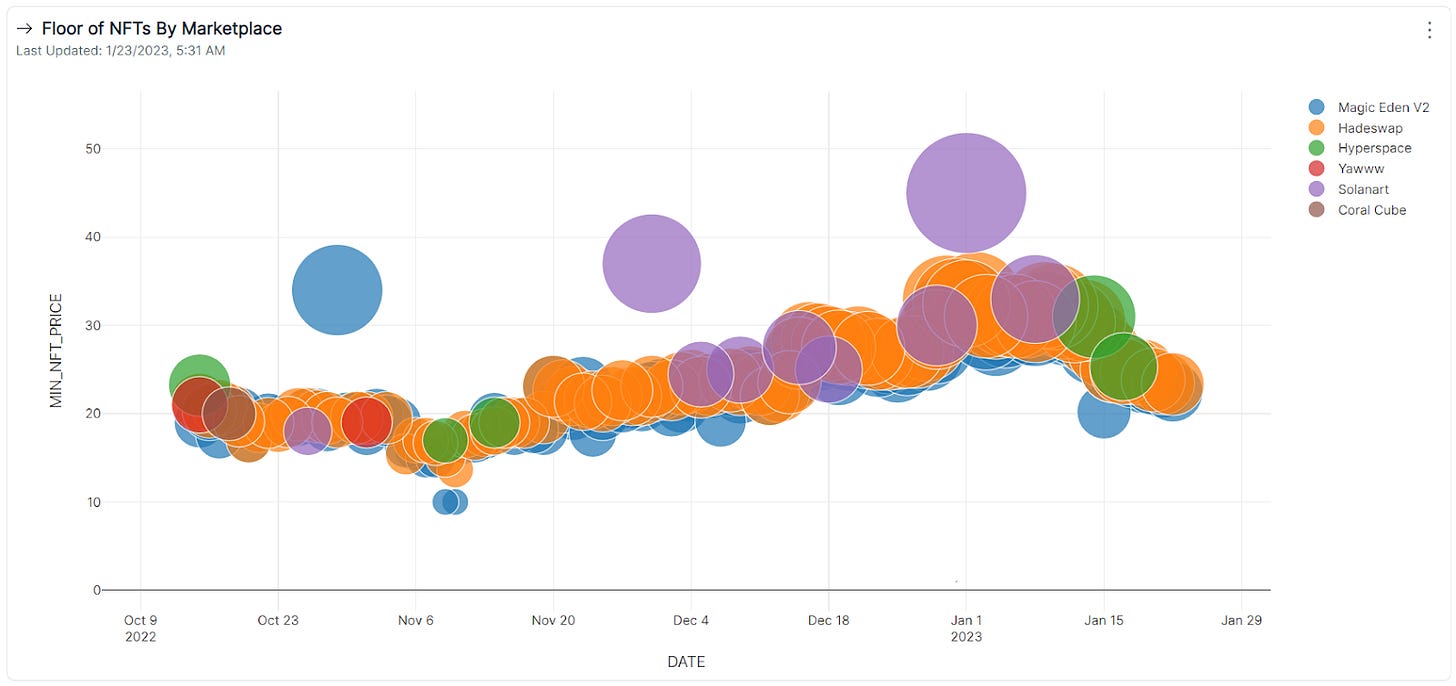

The below chart shows the Aurory NFT Collection’s floor price across multiple marketplaces.

Floor price on Magic Eden has been the lowest among the marketplaces. This can be attributed to the high volume on Magic Eden. So manipulating the floor on Magic Eden may be difficult for the manipulators.

But marketplaces, where the volume is not so high, can be an easy target for the manipulators.

Below is an outdated graph of NFT floors across marketplace. But it can give a sense of how the floor is across them.

Source: Flipside crypto, https://app.flipsidecrypto.com/dashboard/cpY3k6

The ramifications of floor manipulation

Whether the price reflection of value or driven by floor price manipulation is one of the biggest challenges for the NFT space.

NFTs are one of the best bets to get more people into web3. NFTs are culturally inclusive and have a fun and exclusive element with them. This helps in bringing more people to the world of web3.

Floor manipulation is a hindrance for the mass adoption of web3 as a whole and not just NFTs. When such floor manipulation happens people think that NFTs are a scam. New buyers overpay and it brings a bad reputation for the NFT ecosystem. This negative sentiment of a manipulated market affects growth.

For smaller artists, the floor manipulation has even worse ramification. A collection price increases because of the manipulation. But what happens once the manipulators move out? Once people realize that the value was manipulated the value of the work will fall as no one will be interested in buying. The manipulation will ultimately lead to the price collapse at the next launch.

This becomes a cycle.

The buyers are affected and new buyers shy away from buying

Because of this the sellers are affected and they will leave

It becomes a threat to the market's existence.

Suggestions on how to reduce this menace

While completely stopping the floor manipulation is difficult, there are a few ways one can safeguard themselves from the scam.

Tools to understand the NFT value

The analysis should be if the NFT is worth the price it is being paid for or not

Remove the outliers from the analysis

Review NFT transaction history

Check the historical averages of the price into consideration and not just the recent floor price. If the average sale price is way below the floor price then the collection floor may be manipulated

Check engagement of communities and followers

Various tools which enables the analysis - Flipside Crypto, SolanaFloor

Offer prices

A better metric to check the user willingness to pay would be the offer price instead of the floor price.

The offer price is the highest amount any buyer is willing to pay for the NFT in the collection. While this also depends on the rarity of the NFT, it is still a better indicator of the value than the floor price.

Marketplace aggregators

Aggregators provide a common UI for NFTs from multiple marketplaces. So the floor price of the NFT is not local to any specific marketplace and reflects a true floor price. Aggregators also make it easy to identify the low-liquidity marketplaces which are easier to manipulate. A few of the famous Solana NFT aggregators are CoralCube and Hyperspace

Please note the floor price analysis across marketplaces can be done in Flipside Crypto as well.

Enhanced transparency measures

The NFT players such as the marketplaces could include measures to determine the authenticity of the buyers. These can be done using blockchain-based verification solutions that do not expose the identity of the buyer but assert credibility and uniqueness.

Along with individuals, another measure should be in place to prevent cartels from manipulating the floors.

Need for more players and responsible players

Builders should work on providing more and better data to evaluate the projects. They should proactively flag the suspected projects so the buyers are aware of the potential pitfalls. NFT price oracles are very few. So building a product which relies on the NFT price data is a big challenge. There is an immediate need for builders to create solutions around this.

Self-regulation in this space is the need of the hour. To prevent buyers from losing their trust marketplaces should have strict policies against insider trading.

Conclusion

Floor price may be a good entry point for beginners to understand the NFT projects but it is far from being an ideal metric.

The floor price manipulation has become a rampant issue. This issue makes new people avoid the NFT space completely thinking it is a manipulated market. The understanding of how the floor price can be manipulated is critical for those new to NFTs.

Buyers should look at multiple parameters before making a decision on whether to buy the NFT or not. It is not just the responsibility of the buyer to be careful but also the responsibility of the ecosystem players. They should actively try to find better solutions for mitigating the floor price manipulation.

NFTs are the best bet to make web3 mainstream and reducing the scams will lead to an exciting time ahead.

Disclaimer:

This piece is not investment advice. It is for educational purposes only. There are a lot of assumptions and predictions which may or may not remain the same in future.